In today’s competitive job market, small businesses face numerous hurdles in attracting and retaining top talent. Offering healthcare benefits is crucial, but traditional health insurance is often too expensive. Many businesses are looking for cost-effective and high-quality alternatives. While traditional insurance options may seem limiting, new solutions are emerging. Health share organizations, typically thought to serve only individuals and families, are now often extending their services to businesses as a benefit for their employees. These organizations provide a collaborative approach to healthcare, aligning with the values of affordability and community support. Could this option be what your small business needs to be attractive to job seekers?

Why Small Businesses Should Consider Offering Health Benefits

For many small businesses, navigating the complexities of healthcare can feel overwhelming. However, offering health insurance can be a strategic investment, even for companies that aren’t required to provide it by law. In the United States, the Department of Health and Human Services typically classifies businesses with fewer than 50 full-time employees as “small businesses” (1). While health insurance isn’t mandatory for these smaller companies, it can offer significant advantages in attracting and retaining valuable employees in a competitive job market.

According to a recent survey by the National Association of Personnel Services (NAPS), 66% of businesses offering health insurance cited it as a key factor in hiring the best employees, while a separate study published in the Harvard Business Review found that 88% of respondents would be more likely to take a lower-paying job if health insurance were offered (2,3). Offering health insurance also reduced turnover and later the costs of finding and training replacements. Other incentives of offering health coverage include:

- Tax incentives: Employer contributions towards employee health insurance are often tax-deductible, helping to offset the cost of premiums.

- Improved employee morale and productivity: Knowing they have access to healthcare can lead to a happier and healthier workforce, potentially boosting productivity.

- Enhanced company culture: Offering health insurance demonstrates your commitment to employee well-being, fostering a more positive and supportive work environment.

Overall, health insurance can be a valuable tool for small businesses, even those not mandated to offer it. By attracting and retaining top talent, reducing turnover costs, and potentially boosting employee well-being, health benefits can contribute significantly to your company’s success.

The High Cost of Traditional Health Insurance: A Major Hurdle for Small Businesses

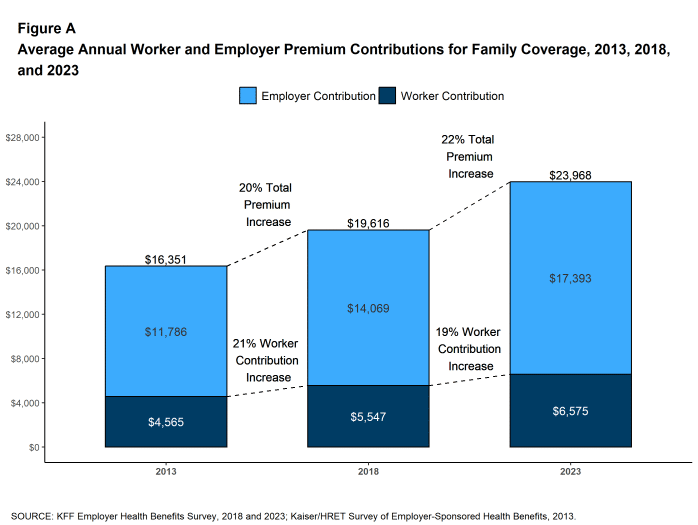

While offering health insurance can be advantageous for a small business, traditional plans often present significant challenges. The rising cost of healthcare is a major hurdle. A 2023 survey by the Kaiser Family Foundation found that the average annual premium for employer-sponsored family coverage has increased by 22% since 2018, see figure below [1]. These rising costs are often compounded by high deductibles, leaving employees with significant out-of-pocket expenses before their insurance kicks in.

The high-cost burden is further illustrated by the Kaiser Family Foundation’s finding that the average annual worker and employer premium contributions for family coverage reached $23,968 in 2023. This significant financial commitment can strain the budgets of small businesses and employees alike. These high costs could risk negating some of the positive effects of even offering health insurance, as employees may still face financial distress due to uncovered medical expenses and high deductibles.

Limitations of Traditional Health Insurance

Beyond cost, limitations within traditional plans can also deter both businesses and employees. Limited network coverage can restrict patient choice, requiring them to utilize specific hospitals or doctors within the plan’s network. Additionally, the potential for coverage denials can create frustration and financial hardship for employees facing medical bills.

These factors, combined with the rising costs, can make it difficult for small businesses to offer an attractive health benefits package without significant financial strain. Without affordable and comprehensive health benefits, potential employees may look elsewhere, leaving small businesses struggling to compete in the job market.

Introducing Health Sharing – A Transparent and Affordable Choice

So how can businesses solve this problem of wanting to provide benefits to their employees, but needing to be able to afford quality options? The solution might lie with health shares. While traditional health insurance can present challenges for small businesses, health sharing organizations offer a viable and increasingly popular alternative. Health sharing is a values-based concept where members directly share in the qualified medical expenses of others within the program.

Health sharing organizations typically operate through a monthly membership structure. Members contribute a set amount each month which is used to pay for qualified medical expenses incurred by other members. Unlike traditional insurance plans with deductibles and copays, health sharing programs have initial unshareable amounts, or the initial amount the member will pay towards their own medical expenses. This structure provides predictable expenses, helping businesses and employees manage their budgets more effectively.

Financial Benefits of Health Sharing for Small Businesses

The financial benefits of health sharing are significant. According to a study by the Kaiser Family Foundation, in the United States, the average monthly cost of health insurance premiums alone is just under $2000 per month. In contrast, health shares tend to be significantly cheaper. For example, a Direct family membership with Zion HealthShare costs between $315-$815 per month, depending on the age of the members and the chosen initial unshareable amount. This substantial difference in cost can free up valuable resources for small businesses, and individuals, allowing them to invest in other areas of their operations or provide additional benefits to employees.

Health sharing organizations address the high costs and limitations of traditional health insurance by offering lower monthly contributions and eliminating restrictive networks. This allows employees to choose their preferred healthcare providers, reducing frustration and increasing satisfaction with their healthcare options.

Other Health Share Benefits Include

- Predictable Expenses: With health sharing, businesses benefit from predictable monthly contributions, simplifying budgeting and financial planning without hidden fees or complex billing processes.

- Tailored Benefits: Health sharing programs offer a range of options, allowing businesses or even employees to choose memberships and additional services that fit their budget and meet the specific needs of their workforce. This flexibility enables companies to design a benefits package that attracts high-performing employees without incurring excessive costs.

- Contribution Options: Businesses have the flexibility to decide how much they contribute toward their employees’ monthly membership contributions, supporting employee well-being while managing their financial commitments. Even if your company can’t currently contribute towards monthly health share contributions, offering this lower-cost benefit can still be attractive to employees, potentially reducing overall healthcare costs for your business.

- Range of Structures: Different health share organizations offer various structures, allowing businesses to find one that best suits their needs.

Learn more about what health share’s offer here: It’s More than an Alternative

Addressing Potential Concerns About Health Sharing for Small Businesses

It is important to note that some health shares are faith-based, which may not be suitable for all employees or businesses. However, there are also non-religious affiliated health sharing options available, such as Zion HealthShare, that cater to a broader range of participants. This flexibility allows businesses to offer a health benefit option that aligns with their values and the diverse needs of their workforce. This variety ensures that businesses can find a health share program that fits their company and employees best.

Health sharing can be particularly beneficial for younger, healthier employee populations who may have fewer medical expenses and prefer a more cost-effective healthcare solution. This demographic often doesn’t fully utilize traditional health insurance benefits, making high premiums seem unjustifiable. Health sharing offers lower monthly contributions, emphasizing preventive care and healthy living, which can resonate well for younger employees. By understanding your employees’ needs and researching different health share organizations, you can find a program that best suits your workforce and mitigates potential risks associated.

The Way Forward: Health Sharing for Small Business Growth

In the challenging landscape of today’s job market, small businesses must innovate to minimize the risk of losing valuable employees and also attract high-performing employees. Traditional health insurance, despite its occasional benefits, often imposes high costs and rigid structures that can burden small business budgets. Health sharing offers a promising alternative, providing cost-effective and flexible healthcare solutions that resonate with the values of affordability and community support.

Exploring health sharing options could provide your business with the edge it needs to offer valuable healthcare benefits without breaking the bank. For more information on how health sharing can benefit your organization, reach out to our team to discuss tailored solutions for your unique needs.

The content in this blog is meant to be informative in nature, but it shouldn’t be taken as medical advice, and it shouldn’t take the place of medical advice or supervision from a trained professional.

Last Revision: 07/10/2024